What Happens To Joint Account When Someone Dies Singapore

If you have a joint account and your co-owner dies you will likely assume full ownership of the account. What that means is that your surviving children does have a claim on your asset but not the HDB flat that you own which would go to your surviving spouse.

Homepage U S Embassy In Singapore

The vast majority of banks set up all of their joint accounts as Joint with Rights of Survivorship JWROS.

What happens to joint account when someone dies singapore. When someone dies any joint brokerage or bank accounts with rights of survivorship can go straight to the joint owner and bypass probate. This type of account ownership generally states. Its illegal to do this if youre not named on the joint account until youve applied for and received the grant of probate.

Bank accounts CDP accounts If either owner passes away the balance in the joint account will pass to the surviving owner. In the event one passes on the share of the person will automatically be passed on the surviving joint tenant s. The bank may freeze the joint account until the surviving owner presents the necessary documentation to the bank.

Most financial institutions just ask you to present the death certificate and fill out the required forms to begin the transfer process. In Singapore law these properties will pass onto the surviving joint-owners automatically upon the death of the other joint-owner. In other words upon one owners death the joint account is transferred to the other owner by default.

Estate Settlement of Equity and Bond In Singapore investment in equities and bonds are held and transacted through Central Depository Pte Ltd commonly known as CDP. In short if one of the signers on. Do check with your bank.

The surviving joint account holder provides the bank with a copy of the death certificate. In Singapore there have been cases wherein the courts held that joint-bank account assets would go to the estate after determining that the deceased parent opened the joint account to benefit all their children and not just the child whose name is on the account. Most joint bank accounts include automatic rights of survivorship.

For real-estate properties that are held as joint tenants these properties cannot be passed on through the operation of a will. Bank will automatically give the account balance to the surviving account holder once the account is closed. What happens to a joint account when someone dies.

Joint-bank accounts and joint-stock brokerage accounts also follow this same logic. What happens to joint accounts when someone dies. If the account is frozen you cant withdraw any money.

Generally the law of survivorshipapplies. However if the joint account holder is a minor below age 21 things can become complicated as the minor cannot give further instruction to the bank or unit trust platform. That person will then take on the deceaseds debt responsibilities.

Therefore if the investor passes away the legal representative needs to settle the estate clearance process with CDP. When the bank knows about a persons death the respective account shall be frozen until court order is obtained. If the bank account is jointly owned.

If you are a holder of a joint account thats a current account you can withdraw money from the account. In Singapore surviving family members are not legally responsible for the debts left behind by the deceased which will have to be written off by creditors. If the bank account in question is a joint account that is there are two names on the bank account and one of them dies then the survivor automatically becomes the sole owner of the account.

Joint bank accounts can provide that the survivor of the joint owners is entitled by right of survivorship to the balance left in the account upon the death of the other joint owner. Thats because most accounts are automatically set up as Joint With Rights of Ownership If you arent sure you can contact your. Bring a proof of identity passport or NRIC.

This is provided the joint account is not pledged to a liability of the bank such as an overdraft. That means the surviving party will take over the investments. Joint accounts eg.

The exception to this is when the deceased has a joint loan account with a surviving family member. Joint accounts are not always subject to probate.

Https Www Ocbc Com Personal Banking Terms And Conditions Pdf Tcs Governing Personal Deposit Accounts Pdf

Simultaneous Death How Are Assets Distributed When Family Members Die At The Same Time Singaporelegaladvice Com

How To Access The Bank Account Of A Deceased Spouse Singaporelegaladvice Com

What If A Beneficiary Dies Before Receiving His Inheritance Singaporelegaladvice Com

How To Access The Bank Account Of A Deceased Spouse Singaporelegaladvice Com

How To Access The Bank Account Of A Deceased Spouse Singaporelegaladvice Com

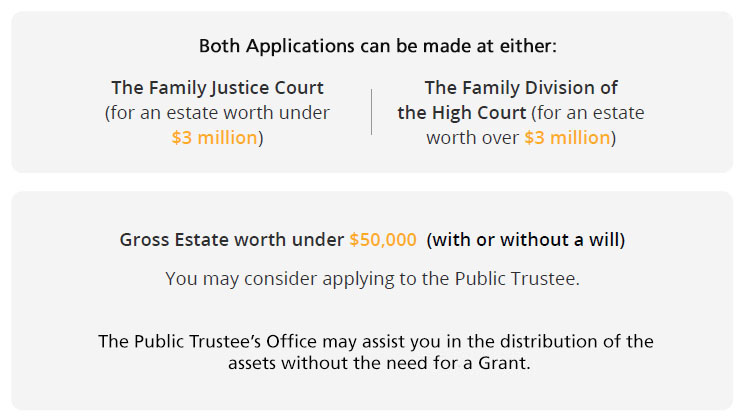

How To Get My Deceased Family Member S Money Out If The Sum Is Less Than 50 000 Through The Public Trustee Investment Moats

/couple-talking-to-bank-employee-about-loan-638070380-5bd22d2cc9e77c00514fc7ef.jpg)

How To Close A Joint Bank Account

How To Open An Estate Account Legalzoom Com

Deciding How To Transfer Your Estate

How To Get My Deceased Family Member S Money Out If The Sum Is Less Than 50 000 Through The Public Trustee Investment Moats

How To Get My Deceased Family Member S Money Out If The Sum Is Less Than 50 000 Through The Public Trustee Investment Moats

What Happens To A Deceased Person S Bank Account King Law

What If A Beneficiary Dies Before Receiving His Inheritance Singaporelegaladvice Com

How To Get My Deceased Family Member S Money Out If The Sum Is Less Than 50 000 Through The Public Trustee Investment Moats

Post a Comment for "What Happens To Joint Account When Someone Dies Singapore"